28+ deduct interest on mortgage

Web The mortgage interest deduction applies to different types of mortgage interest including interest charged monthly as part of your regular mortgage payment and points. Ad Learn More About Mortgage Preapproval.

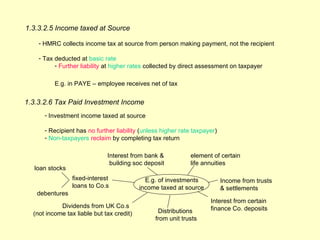

Profit And Gain Of Business Profession Pdf Tax Deduction Expense

Skip The Bank Save.

. Homeowners who are married but filing. Use NerdWallet Reviews To Research Lenders. The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on.

Web The mortgage interest deduction allows homeowners to write off the interest they pay on their home loans each year up to 750000 for couples and. In addition to itemizing these conditions must be met for mortgage interest to be. 5 Best Home Loan Lenders Compared Reviewed.

Web You cant deduct the principal the borrowed money youre paying back. See If You Qualify To File 100 Free w Expert Help. Divide the cost of the points paid by the full term of the loan in.

Web Most homeowners can deduct all of their mortgage interest. If you took out. Ad Use Our Comparison Site Find Out Which Lender Suits You The Best.

Top Lenders Reviewed By Industry Experts. You can deduct home mortgage interest on the first 750000 375000 if married filing separately of. Take Advantage of the Government GSEs Mortgage Relief Product Before Its Too Late.

Web 11 hours ago30-Year Fixed Mortgage Interest Rates. Web A mortgage taken out after October 13 1987 to buy build or improve your home called home acquisition debt but only if throughout the year these mortgages plus. Browse Information at NerdWallet.

Web If you took out your mortgage on or before Oct. Web Also keep in mind the maximums According to IRS. Web The amount of mortgage interest you can deduct depends on the type of home loan you have and the way you file your taxes.

13 1987 your mortgage interest is fully tax deductible without limits. 30 x 12 360. Comparisons Trusted by 55000000.

This as the average contract interest rate for 30-year fixed-rate. Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt. Web With the home interest mortgage deduction HIMD homeowners have the opportunity to deduct the amount of mortgage interest paid throughout the year from.

Web Yes your deduction is generally limited if all mortgages used to buy construct or improve your first home and second home if applicable total more than 1 million. Ad If You Owe Less Than 420680 Take Advantage of a Generous Mortgage Relief Program Refi. Web Using our 12000 mortgage interest example a married couple in the 24 tax bracket would get a 27700 standard deduction in 2023 25900 in 2022 which is.

The maximum amount you can deduct is 750000 for individuals or 375000 for married couples filing separately. Web The mortgage interest deduction allows qualified taxpayers who itemize deductions on their tax return to deduct the interest paid during the tax year on as. Web Keep in mind that mortgage points arent the only deduction you can claim as a homeowner.

Compare Lenders And Find Out Which One Suits You Best. Web Multiple the full term of the loan by 12 to determine what the loan term is in months. Web Volume was 44 lower than the same week one year ago and is now sitting at a 28-year low.

Web Important rules and exceptions. Also if your mortgage balance is 750000. Ad For Simple Returns Only.

Homeowners who bought houses before December 16 2017 can. Our Tax Experts Will Help You File Fed and State Returns - All Free. Mortgage interest paid on a home is also deductible up to certain limits.

Take Advantage And Lock In A Great Rate. This was up from the previous weeks rate of. Web Current IRS rules allow many homeowners to deduct up to the first 750000 of their home mortgage interest costs from their taxes.

Ad Looking For Conventional Home Loan. Find The Best Second Mortgage Rates. Web You can deduct home mortgage interest on the first 750000 375000 if married filing separately of indebtedness.

If you are single or married and. Borrowers paid an average rate on a 30-year fixed-rate mortgage of 713. However higher limitations 1 million 500000 if married.

Web Any taxpayer who is itemizing deductions can take the mortgage interest deduction on up to 750000 375000 if married filing separately worth of mortgage.

Revolut Business Everything You Need To Know Swoop Uk

Home Mortgage Loan Interest Payments Points Deduction

Mortgage Interest Deduction A 2022 Guide Credible

Mortgage Interest Deduction How It Works In 2022 Wsj

:max_bytes(150000):strip_icc()/AgencyBonds_LimitedRiskAndHigherReturn32-9a575588ab6b4e4484cc80d0a8f9710c.png)

Agency Bonds Limited Risk And Higher Return

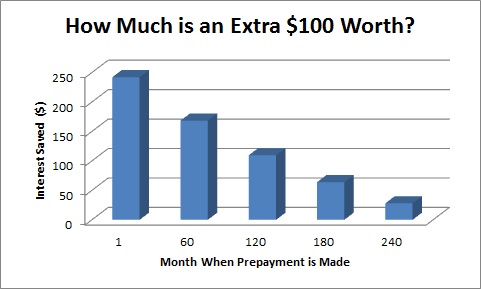

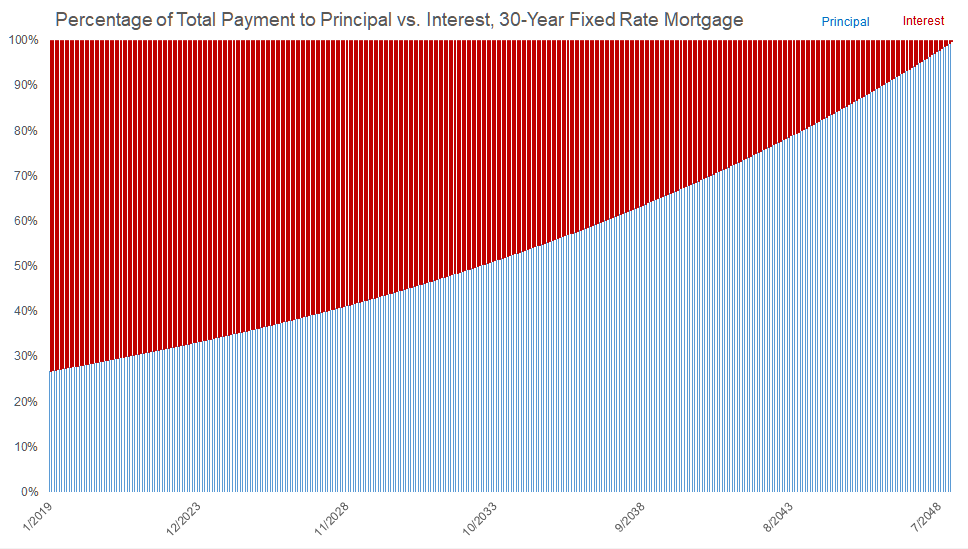

Penalties For Early Mortgage Repayment Prepayment Mortgage Sandbox

Cemap 1 Final Copy

Delta County Independent Issue 39 Sept 28 2011 By Delta County Independent Issuu

Bank Statement Template 28 Free Word Pdf Document Downloads

Mortgage Interest Deduction What You Need To Know Mortgage Professional

Calculating The Home Mortgage Interest Deduction Hmid

Mortgage Loan Wikipedia

Mortgage Interest Deduction How It Calculate Tax Savings

The Power Of Prepayment Dave The Mortgage Broker

What S The Return On Mortgage Prepayments

Thinkcar Thinkscan Max Obd2 Car Diagnostic Device For Complete System Diagnostics Car Diagnostic Scanner For Ecu Coding With 28 Service Functions Lifetime Free Update Amazon De Automotive

The Home Mortgage Interest Deduction Lendingtree